The landmark Inflation Reduction Act (IRA) is all anyone can seem to talk about since President Biden first signed it into law on August 16, 2022. What is it? Who will benefit? But the average homeowner is probably asking themselves “How will it help me?”

With just over $370 billion in funding, the bill represents the largest investment toward reducing greenhouse emissions by providing incentives directly to consumers to help hasten the transition away from fossil fuels.

Through an assortment of tax credits and rebates, the IRA seeks not just to make heat pumps, solar, and EVs the most affordable option; it also aims to ensure that these products are produced here in the United States by American workers. City Light’s Building Electrification Intern Shelby Ketchum previews how City Light customers can save by combining IRA and City Light incentives.

Making your home energy efficient and emissions-free

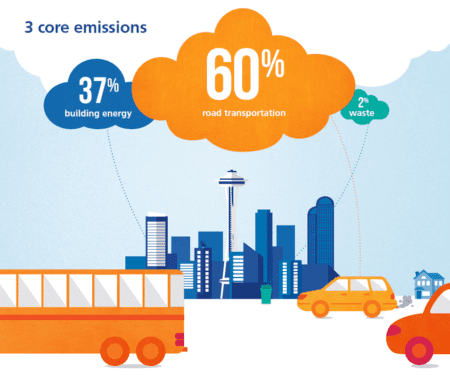

Seattle’s building operations represent 37% of our area’s greenhouse gas emissions, second only to transportation. We can reduce these emissions by replacing fossil fuel-powered furnaces and water heaters with electric models that operate on City Light’s carbon-neutral electricity. The IRA provides expanded tax credits and new direct point-of-sale rebates toward the purchase and installation of electric equipment to assist in these upgrades.

Starting this year, households can use the expanded tax credits to deduct up to 30% of the cost of clean energy and energy efficiency upgrades to their homes. This includes rooftop solar, battery storage, electrical panel upgrades, and appliances and other equipment also eligible for City Light’s home energy solutions rebates—like heat pumps for heating, cooling, and water heating. You can pair our incentives with the tax credits to bring the costs down even further! Find more information about City Light’s home energy solutions rebates and federal clean energy tax credits.

In 2024, larger, upfront discounts—up to $14,000—will be available for income-qualified households for many of the same products included in the tax credits. Households whose yearly income is at or below 150% of the area media will likely be eligible for upfront discounts, with larger discounts available for lower income brackets. More details about these discounts will be determined throughout 2023. Customers can find more information and get the latest updates from the White House’s Clean Energy for All online resource.

Expanded EV benefits and rebates

The growing number of electric cars, buses and delivery vans is one of the clearest indicators that the energy transition is already well underway. To help reduce the upfront cost and speed adoption, the IRA is providing a $7,500 tax credit for certain new EVs starting in 2023. Starting in 2024, the incentive switches from a tax credit to a point-of-sale incentive where consumers can claim the savings directly at the dealership or direct from the automaker. Three major criteria restrict which EVS qualify for the incentive:

- Geographic restrictions on where a percentage of critical minerals for the battery are originally sourced or recycled*

- Geographic requirements for where a percentage of the vehicle’s battery components are manufactured or assembled*

- The full vehicle must be assembled in North America

*The first two criteria become more strict over time.

Currently, there are few cars that meet these standards. However, the Inflation Reduction Act is also investing hundreds of billions of dollars in manufacturing tax credits for new EV and battery plants to expand the availability of eligible models and support clean energy jobs in the United States.

The Department of Energy has compiled this helpful list of eligible vehicles for current models and the IRS has produced a set of factsheets for new and used EVs. Interested in seeing if an EV is right for you? Check out the electric vehicles page on our website for consumer guides and information on vehicle charging.

What’s next for our clean energy future

City Light is excited about the IRA and its ability to reduce barriers to equitable access to clean energy technologies. We are committed to providing our customers with carbon-neutral electricity and partnering with community and others to lead our region in decarbonization. We continue to aggressively pursue energy efficiency to affordably counter-balance electrification and we’re investing in a modernized grid and distributed energy resources needed to increase customer options and benefits. As we create our energy future, we seek to reverse historic inequity and avoid collateral harm. Learn more about the strategies that support the future of energy work.

Ready to get started? A City Light Energy Advisor can help you identify more ways to be energy efficient, save money, and help save the planet.

Shelby Ketchum is a graduate intern with Seattle City Light’s Building Electrification team.